How to think about risk

In a world of change, the biggest risk is standing still

Kudos to my friend Corey Coto for sending me this video. It’s fantastic and broadly applicable to more of life than just investing. I suggest you watch it.

Learning how to think about concepts — like risk — is more important than what to think.

The quality of “returns” for how you invest your time or your money relative to the risk taken is the ultimately test of skill. This meditation is an editorial of my favorite parts.

Risk is not volatility, risk is the probability of loss — Howard Marks

Asymmetry of returns

A crucial concept to understand. For example, in SaaS there are many activities that have linear inputs and linear outcomes. Sometimes this makes sense — say scaling a salesforce in a B2B model of a later stage company where you need to lock-in large annualized contracts.

But its also the principle behind product led growth efforts that work: inputs can lead to exponential outcomes via growth loops.

Quantification

Howard challenges the conventional notion of risk by suggesting that it can’t be quantified — in advance or hindsight.

I had to listen to that a few times for it to truly sink in.

Here’s how I’m thinking through this now. First, a few key points:

Subjectivity of probabilities: Since the future is inherently unpredictable, any assessment is based on estimates shaped by perspective, information at hand and biases. Even if we assign probabilities (which we do), they themselves are estimates.

Inability to quantify in advance: Models rely on fitting to a past distribution of data. They inherently can’t capture the unseen (e.g. black swan events).

Inability to quantify in hindsight: Outcome bias is real. Just because something was profitable doesn’t mean it was risky. Losing doesn’t mean something was high risk.

OK, so now for two examples to help make this stick.

Scenario 1: You buy a lottery ticket and win the jackpot.

Analysis: Winning doesn't change the fact that the odds were overwhelmingly against you. The risk (low probability of winning) remains the same, but the favorable outcome can create the illusion that the risk was lower than it actually was.

Scenario 2: As a homeowner you pay for fire insurance every year. Your house never catches fire.

Analysis: Was buying insurance unnecessary? As a homeowner you cannot quantify the risk of your house catching fire in any given year. Even in hindsight, knowing the house didn't burn doesn't quantify the risk; it merely shows one possible outcome.

So what should we do if quantitative estimates can often provide a false sense of certainty about the future?

For one, weave in qualitative assessment on the probability of loss from experts even if imprecise. The point here is that nuanced judgments can help fill in the gap of models.

Forms of risk

Gosh this part was gold. What stood out?

Missed opportunities: what most of us commonly refer to as opportunity cost

Not taking enough risk as a form of risk: my favorite

Being forced out at the bottom: the risk of missing the eventual upswing

Counterintuitive risk: example, removing stop signs actually increases vigilance

Overpaying for perceived high quality: my second favorite.

Let’s explore that last one because its closely related to not taking enough risk.

Awaken; return to yourself. Now, no longer asleep, knowing they were only dreams, clear-headed again — VI. 31

Many of us, myself including, are easily deluded by what we perceive as “safe options”.

This could be buying a “blue chip” asset at a market top or taking a job for the title or prestige.

But its not what you buy, it is what you pay.

Returns come not from buying good things but from buying them well.

The appreciation potential and upside left for you to capture.

Concluding thoughts

Perfect sense: that which is perceived to be risky have to also be perceived as offering higher returns.

Most of us think about this in a linear way and are familiar with a graph that suggests a dependable positively correlated relationship, like below.

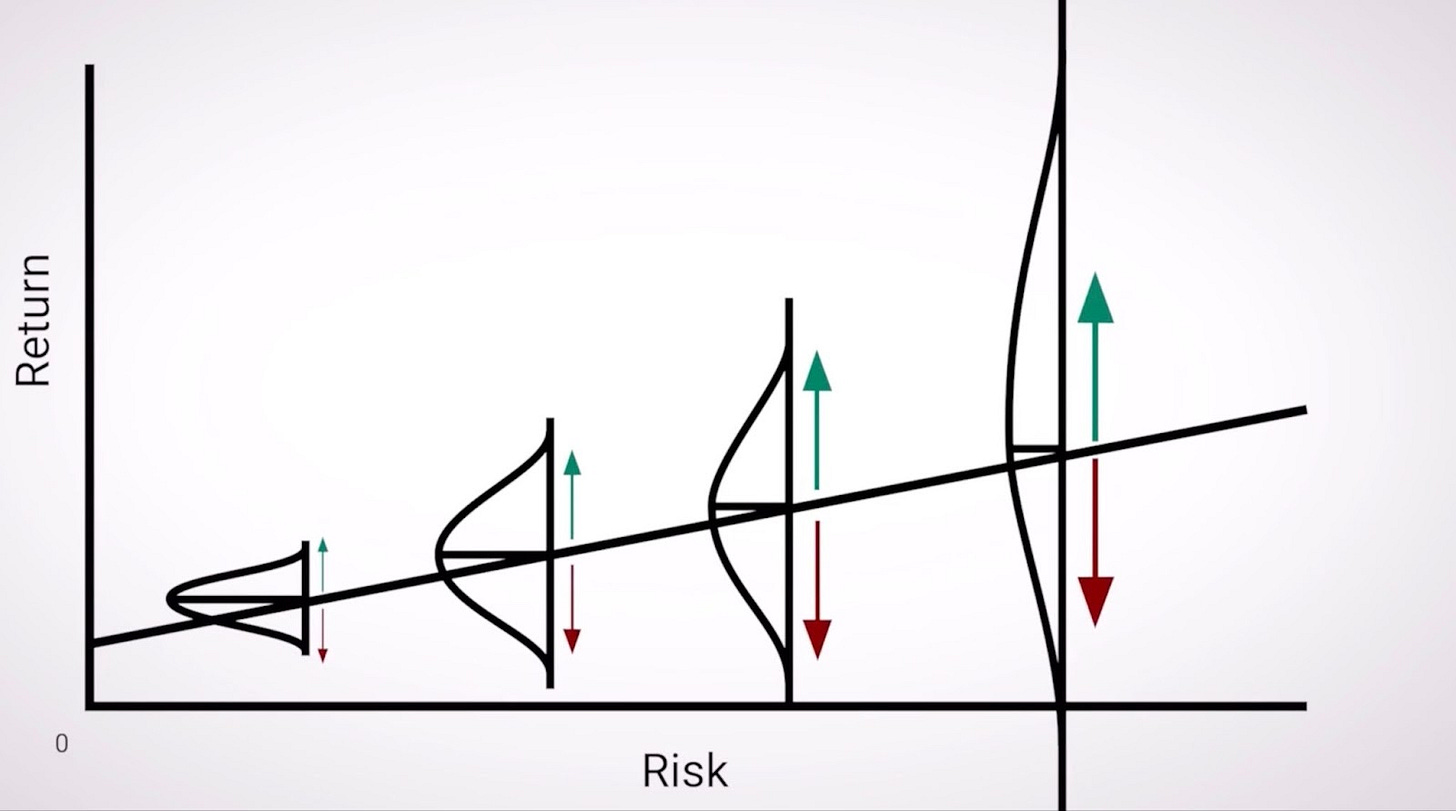

Students of statistics realize however that this line is best fit to an underlying distribution — whose data points look a lot more like Mark’s excellent visualization.

The overarching takeaway — risk control is indispensable but risk avoidance equates to return avoidance.

We’re at an inflection point and the world has changed and will continue at an accelerated rate. Some call it the Intelligence Age1 .

Its easy to find fault with the prognostications.

But do know the biggest risk is standing still.

https://ia.samaltman.com/

Great article my friend!

I really like how you clearly articulated this: "Learning how to think about concepts — like risk — is more important than what to think."